Policies purchased after March 20th, 2023 should refer to this page for benefit information.

SUMMARY OF COVERAGE*

TRAVEL INSURANCE BENEFITS

TRIP CANCELLATION/TRIP INTERRUPTION | Maximum benefit: Trip Cost

Reimburses forfeited, non-refundable, unused payments or deposits up to the maximum shown on the Schedule of Benefits or trips that are canceled or interrupted due to covered reasons such as:

(a) accidental injury, sickness or death of you, your traveling companion, your family member or your business partner;

(b) death or hospitalization of your host at destination; inclement weather, natural disaster, or terrorist attack at point of departure or destination which renders accommodations uninhabitable;

(c) mandatory evacuation at final destination due to hurricane or other natural disaster;

(d) named hurricane causing cancellation of travel at destination;

(e) natural disaster or man-made disaster at destination which renders accommodations at destination uninhabitable;

(f) common carrier strike for at least 24 hours;

(g) common carrier mechanical breakdown which results in cancellation or suspension of travel;

(h) employment transfer causing principal residence relocation;

(i) termination or laid off from employment from a place of employment which you have been employed for past 3 consecutive years;

(j) company is directly involved in a merger or acquisition;

(k) your business operations interrupted by fire, flood, burglary, vandalism, product recall, bankruptcy, natural disaster, or financial default;

(l) within 30 days of departure, a politically motivated terrorist attack occurs within a 100 mile radius of the city to be visited, and if the United States government issues a travel advisory indicating that Americans should not travel to a city named on the itinerary;

(m) bankruptcy and/or default of travel supplier which occurs more than 14 days following effective date;

(n) documented theft of passports or visas;

(o) unable to participate in a scheduled hunting, fishing, or sport expedition due to a delay of personal necessary sports equipment by customs or common carrier;

(p) hijacked; quarantined;

(q) required to serve on a jury, subpoenaed, required to appear as a witness in a legal action, provided you are or your traveling companion are not a party to the legal action or appearing as a law enforcement officer, the victim of felonious assault, having principal place of residence made uninhabitable by fire, flood or other natural disaster, or burglary of principal place of residence within 10 days of departure;

(r) directly involved in or delayed due to a traffic accident substantiated by a police report, while en route to departure;

(s) called to emergency duty due to a natural disaster other than war, military duty within 30 days of departure, or your leave revoked or are redeployed;

(ts) United States government or government authorities at destination prohibit the kind of activities you planned to do, prohibitions include: closing a reserve, banning all hunting, declaring the kind of hunting you were planning to do illegal, any other prohibitions we approve;

(u) cancellation of your covered trip if your arrival on the covered trip is delayed and causes the loss of 50% or more of the scheduled covered trip duration due to the reasons covered under the trip delay benefit.

For a complete list of covered reasons, refer to the Certificate of Insurance or Policy.

TRIP DELAY | 3 hrs min delay, $200 per day, $1,000 max

Reimburses up to $200 per day/per person up to the maximum shown in the schedule of benefits for additional expenses if delayed en route to or from the covered trip for 3 or more hours due to defined hazard.

MISSED CONNECTION | Maximum Benefit: $1,000

Reimburses up to the benefit shown in the schedule of benefits for missed departure due to cancellation or delay for 3 or more hours of all regularly scheduled airline flights due to inclement weather or any delay caused by common carrier. Benefits are provided to cover additional transportation expenses needed to join the trip, reasonable accommodations and meal expenses and non-refundable trip payments for the unused portion of trip.

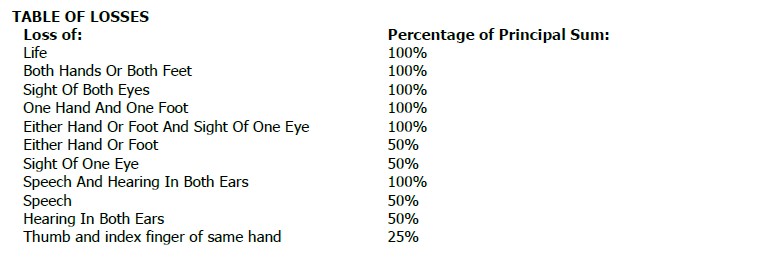

ACCIDENTAL DEATH & DISMEMBERMENT | Principal Sum: $25,000

We will pay the percentage of the Principal Sum shown in the Table of Losses when You, as a result of an Accidental Injury occurring during the Covered Trip, sustain a loss shown in the Table below. The loss must occur within 365 days after the date of the Accident causing the loss. The Principal Sum is shown on the Schedule of Benefits.

If more than one loss is sustained as the result of an Accident, the amount payable shall be the largest amount of a sustained loss shown in the Table of Losses.

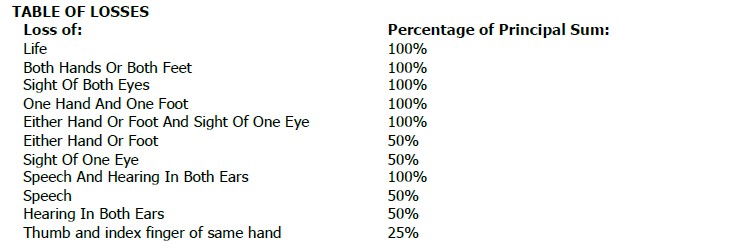

ACCIDENTAL DEATH & DISMEMBERMENT – COMMON CARRIER | Max Benefit: $100,000

We will pay benefits for Accidental Injuries resulting in a Loss as described in the Table of Losses below, that occurs while You are riding as a passenger in or on, boarding or alighting from, any air, sea or land conveyance operated under a license for the transportation of passengers for hire during the Covered Trip. The Loss must occur within 365 days after the date of the Accident causing the Loss. The Principal Sum is shown on the Schedule of Benefits.

If more than 1 Loss is sustained as the result of an Accident, the amount payable shall be the largest amount shown.

ACCIDENT OR SICKNESS MEDICAL EXPENSE | MAXIMUM BENEFIT: $100,000

We will pay Reasonable and Customary Charges up to the limit shown on the Schedule of Benefits, if You incur necessary Covered Medical Expenses as a result of an Accidental Injury or Sickness which occurs during the Covered Trip. You must receive initial treatment for Accidental Injuries or Sickness while on the Covered Trip.

Covered Medical Expenses include but are not limited to:

(a) the services of a Physician;

(b) charges for Hospital confinement and use of operating rooms, Hospital or ambulatory medical-surgical center services (this will also include expenses for a Cruise ship cabin or Hotel room, not already included in the cost of Your Covered Trip, if recommended as a substitute for a Hospital room for recovery from an Accidental Injury);

(c) charge for anesthetics (including administration); x-ray examinations or treatments, and laboratory tests;

(d) ambulance service;

(e) drugs, medicines, prosthetics and therapeutic services and supplies;

(f) emergency dental treatment for the relief of pain.

We will not pay benefits in excess of the Reasonable and Customary Charges. We will not cover any expenses incurred by another party at no cost to You or already included within the cost of the Covered Trip.

We will pay benefits, up to $750.00, for emergency dental treatment for Accidental Injury to sound natural teeth.

We will advance payment to a Hospital, up to the maximum shown on the Schedule of Benefits, if needed to secure Your admission to a Hospital because of Accidental Injury or Sickness.

PRE-EXISTING MEDICAL CONDITION EXCLUSION WAIVER

BAGGAGE INSURANCE COVERAGE

BAGGAGE AND PERSONAL EFFECTS | Maximum Benefit: $2,500

Will pay up to the maximum shown on the schedule of benefits, for loss, theft or damage to Baggage and personal effects, provided all reasonable measures to protect, save and/or recover the property has been taken. There is a per article limit of $300. The Baggage and personal effects must be owned by and accompany you during the trip. If you have checked your baggage with a common carrier and delivery is delayed, coverage for baggage will be extended until common carrier delivers it.

BAGGAGE DELAY | 12 hours min delay, $600 max

Will pay up to the maximum shown on the schedule of benefits, if your checked baggage is delayed or misdirected by common carrier for more than 12 hours.

BAGGAGE DELIVERY | Maximum Benefit: $100

If Your Checked Baggage is delayed after You have reached Your destination and the Common Carrier makes a charge for delivery, We will pay the reasonable cost up to the Baggage Delivery Maximum Benefit shown on the Schedule of Benefits to deliver Your Checked Baggage to Your Destination. A copy of the delivery invoice and verification of the delay or misdirection by the Common Carrier must be submitted with the claim.

BAGGAGE/PERSONAL EFFECTS – SPORTS EQUIPMENT | Maximum Benefit: $5,000

If your sports equipment is lost by common carrier, or damaged, or stolen, we will pay up to the amount in the schedule of benefits provided all reasonable measures to protect, save and recover property has been taken.

ASSISTANCE SERVICES

Travel assistance, medical consultation, security consultation and intelligence services are provided by Redpoint Resolutions, an elite team of special operations veterans, physicians, paramedics, nurses, and other medical and security professionals.

MEDICAL EVACUATION SERVICES

Covers evacuation to the nearest suitable hospital as directed by a physician if medically required.

MEDICAL AND SECURITY CONSULTATIONS

Critical medical advice from paramedics, nurses and physicians, combined with expert security consulting services from military and intelligence veterans.

TRAVEL ASSISTANCE

Travel assistance services to include passport assistance, prescription refill, payment guarantees, cash advance and more.

CANCEL FOR ANY REASON (CFAR)

Up to 75% of Trip Cost – Optional for additional cost

Cancel For Any Reason

(a) this coverage is purchased within 14 days of the date the initial Payment or Deposit is paid and You insure the cost of any subsequent arrangement(s) added to the same Covered Trip within 14 days of the date of Payment or Deposit for any such subsequent Covered Trip arrangement(s); and

(b) this insurance coverage is purchased for the full cost of all non-refundable prepaid Covered Trip arrangements; and

(c) You or Your designated representative cancels the Covered Trip no less than 2 days prior to the Scheduled Departure Date.

This coverage will be terminated, no benefits will be paid and any premium paid for this coverage will be refunded if the full costs of all prepaid, non-refundable Covered Trip arrangements are not insured.

* This is only a summary of our program. Please read the policy carefully to fully understand the coverages, terms, conditions, limits and exclusions. Not all plans or coverages are available in every state. This summary does not replace or change any part of your policy. If there is a conflict between this summary and the policy, the policy will control. Please contact us if you have any questions.

Optional Travel Insurance Coverage:

This summary is only a brief description of the coverage(s) available under policy series PC_AHR_RCH (01/2021). This summary does not replace or change any part of your policy. The policy will contain reductions, limitations, exclusions, and termination provisions. Please read the policy carefully to fully understand the coverages, terms, conditions, limits and exclusions. If there is a conflict between this summary and the policy, the policy will control. This policy provides insurance coverage that only applies during a covered trip. You may have coverage from other sources that provides you with similar benefits. You may wish to compare the terms of this policy with your existing life, health and homeowners’ policies. Please contact +1 415 481 0600 if you have any questions. Insurance underwritten by State National Insurance Company Inc., a Texas domiciled corporation (NAIC Company Code: 12831; TX license number 6026) with its principal place of business at 1900 L Don Dodson Drive, Bedford, TX 76021. Not all plans or coverages are available in every state. It is a crime to knowingly provide false, incomplete, or misleading information to an insurance company for the purpose of defrauding the company. Penalties include imprisonment, fines, and denial of insurance benefits.

Travel Assistance Coverage:

Redpoint Resolutions LLC provides evacuation, travel assistance and non-insurance services. Evacuation, travel assistance and non-insurance services are not insurance and are provided through a membership program. An evacuation, travel assistance and non-insurance service program may be purchased individually without travel insurance. By selecting the “Evacuation only, no travel insurance” coverage option, you will be purchasing a Redpoint Resolutions evacuation, travel assistance and non-insurance service program membership.

UnivOps Insurance Services LLC is the licensed insurance agent.