What You Need To Know About Trip Delay Insurance

Trip delay insurance is a travel insurance benefit that reimburses you if your trip is delayed for a certain amount of time.

It's a useful benefit to have if your trip involves a lot of flights, transfers, and connections, because it reimburses you for expenses that may come up throughout the course of your journey. The more complex your journey, the more likely there is to be a travel delay — and the slew of unexpected costs that come with it.

How Trip Delay Insurance Works

Many people don’t realize that airlines are not always required to reimburse traveler expenses for flight delays. While many carriers will pay for a traveler’s food and lodging if their flight is significantly delayed, they will typically not cover it if they decide the reason for the delay isn’t their fault (i.e., bad weather).

This is a common occurrence that can be frustrating for travelers who are expecting compensation, and the U.S. Department of Transportation (DOT) recently stepped in to address the issue, passing a new rule declaring that passengers on flights to, from, or within the U.S. are entitled to an automatic refund from their carrier if any of the following apply:

- Your flight is canceled or changed significantly, and you don’t want to be rebooked or take the flight;

- Your checked baggage is significantly delayed;

- You paid for extra services, such as in-flight Wi-Fi, that weren’t provided.

According to the DOT, the following would be considered a “significant change”:

- A domestic flight that departs or arrives more than three hours before or after it was scheduled;

- An international flight that departs more than six hours before or after it’s scheduled;

- The airport you’re arriving in or departing from changes;

- The number of connections increases;

- You’re downgraded to a lower class of service;

- If you have a disability, you’re offered a less accessible or accommodating flight or connection, either on a different plane or at a different airport.

Of course, as with any policy, there are still some exceptions, and trip delay insurance can help cover those gaps.

What Trip Delay Insurance Covers

Trip delay insurance covers any reasonable expenses you might incur during the course of your delay.

Covered trip-delay expenses include things like:

- Extra meals or snacks

- Additional accommodation

- Local transportation, such as a taxi ride to a hotel room nearby

- Any personal items, such as toiletries or medication, you have to purchase during your delay

Most travel insurance policies require a minimum length of time before delay coverage kicks in. It’s usually somewhere in the region of six to 12 hours, but check your specific policy for details.

Trip delay insurance also covers delays for a variety of reasons that airlines or other carriers typically won’t reimburse you for, such as weather or any unforeseen events.

What Trip Delays Are Not Covered By Travel Insurance

If you do get reimbursed by your airline or other carrier for a delay they caused, you can’t also make a claim on your trip delay coverage.

If the delay in question is under the minimum time threshold stated by your policy, you can’t claim for expenses incurred during that period.

And if you yourself are the cause of the delay — say, you missed your first flight because you were late to the airport and had to wait around for the next one — that will not be covered by travel delay insurance.

Trip Delay vs. Trip Interruption Insurance

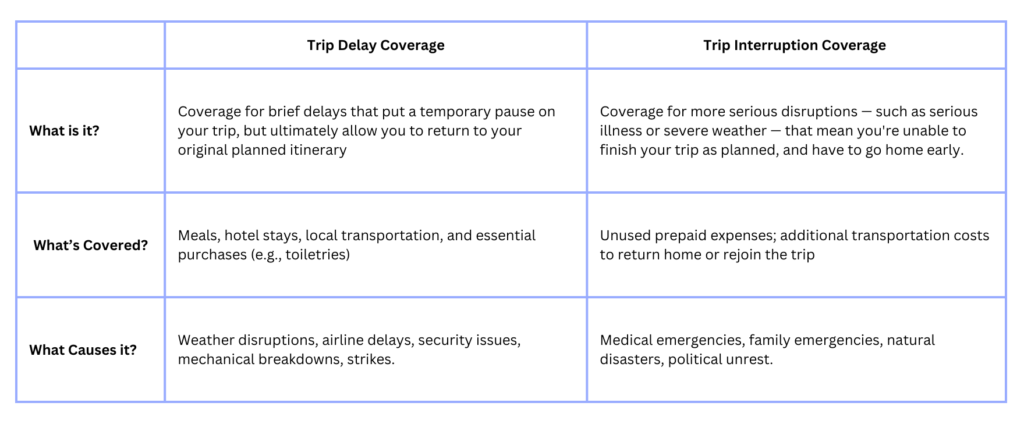

Trip delay benefits and trip interruption coverage are two separate things. See the table below to understand the different benefits and why you might need them.

Tips and Factors to Consider When Selecting a Trip Delay Insurance Policy

- Be aware of any exclusions stated by your policy, and be clear on the instances in which it won’t cover a delay, such as when you’re already being reimbursed by the airline.

- Look at the minimum time required before your travel delay coverage kicks in. That way you’ll have a sense in advance if a delay is likely to be covered by your travel insurance, and whether or not you should try to make a claim.

- Be aware of what specific items are considered reasonable expenses during a delay. These usually include food and drink, accommodation, transportation, and personal essential items.

- Be aware of the maximum benefit paid out by your trip delay coverage. That will help prevent you from overspending on meals or accommodation that won’t be reimbursed.

- Make sure you know what kind of proof your carrier requires for reimbursement of expenses — that way if you hit a delay, you’ll be one step ahead of the game. In general, you’ll want to keep a detailed record of all the expenses incurred throughout the course of your delay, including proof of the delay from the carrier stating the length of the delay, as well as receipts and other proof of your spending. This will make it much easier to make a successful claim.

FAQs About Trip Delay Insurance:

1. Does travel insurance reimburse for delays?

Coverage applies when delays exceed a specified duration (typically six to 12 hours), due to reasons like severe weather, mechanical issues, and airline strikes.

2. What is considered a trip delay?

Travel insurance typically outlines a minimum length of time a travel delay must be for coverage. This will vary by policy.

3. What can I claim for a trip delay?

There are maximum benefit amounts, so check your policy to ensure you don't overspend during your delay.

4. Are trip delay and flight delay insurance the same?

Trip delay covers delays affecting your overall journey, including layovers and connecting flights, while flight delay insurance specifically compensates for airline-related delays.

Trip delay insurance often provides broader protection, including accommodations, meals, and transportation, whereas flight delay coverage is more limited.

5. Do I need trip delay and trip interruption insurance?

Having both ensures broader protection against travel disruptions, beyond simple delays.

Redpoint Travel Protection Is Here to Help

Redpoint Travel Protection is designed to give you the peace of mind to enjoy your trip to the fullest. Our comprehensive, easy-to-understand insurance policies include coverage for delays, so you can book your trip with confidence. Explore our three travel insurance plans — Ripcord, Cavalry, and Harbor — and get a quote for your next trip today.