Expert Advice for Quickly Processing a Travel Insurance Claim

September 22, 2025

Expert Tips to Speed Up Your Travel Insurance Claim Process

How to Speed Up Your Travel Insurance Claim with Redpoint

Once you've purchased travel insurance, it usually slips to the back of your mind as you prepare for your upcoming trip. But if something goes wrong and you need to make a travel insurance claim, you'll soon find yourself wondering how to file a successful claim, and if there are any steps you can take to increase your odds of approval.

The good news is that there are lots of things you can do to help ensure that your travel insurance claim is approved in a timely manner. Let's take a look at some expert advice for quickly processing a travel insurance claim.

If you want a quick, clear, and positive resolution of your travel insurance claim, then you need to do a small amount of work up front to ensure you have all your documentation and relevant information ready to go. Speeding up travel insurance claims is all about being organized, clear, and timely — all so your travel insurance provider has an easier time assessing your claim.

Here's a step-by-step guide to navigating the travel insurance claims process.

Step-by-Step: Filing Your Travel Insurance Claim Efficiently

Step 1: Review Your Policy Details

The first step is to ensure that your policy benefits actually cover the incident you are making a claim for. Find your coverage details, which were likely sent to you via email or mail when you purchased the policy. Read the relevant section for the claim you are making, and check if any exclusions or limitations may affect your situation. For example, if you’re making a trip cancellation claim, then ensure the reason you’re cancelling is indeed a covered reason, such as a natural disaster, political unrest, or a death in the family. In addition, check for any deadlines, such as whether you must make your claim within a certain time limit.

Step 2: Gather Essential Documentation

Now that you’ve confirmed your incident will be covered by your insurance plan, you need to gather evidence. This is written and official proof of any costs you incurred that you are claiming reimbursement for. Examples of proof and documentation may include:

- Medical records and itemized bills for any medical emergency you received care for.

- Any and all receipts for expenses claimed, whether for medical expenses, alternative accommodation, or basic essentials.

- Proof of original itinerary.

- Booking confirmations for reservations that you want to claim reimbursement for.

- Proof of travel (boarding pass, tickets, etc.).

- Receipts for lost or stolen items.

- Police reports or an incident report if you were the victim of theft or another crime.

- Communications with an airline or travel provider about changes or cancellations to an itinerary.

- Death certificate, if you’re cancelling due to a death in the family.

- Doctor’s note, if you’re cancelling due to an illness.

- Communications from the embassy or consulate if you were ordered to evacuate.

Step 3: Submit Your Claim Promptly

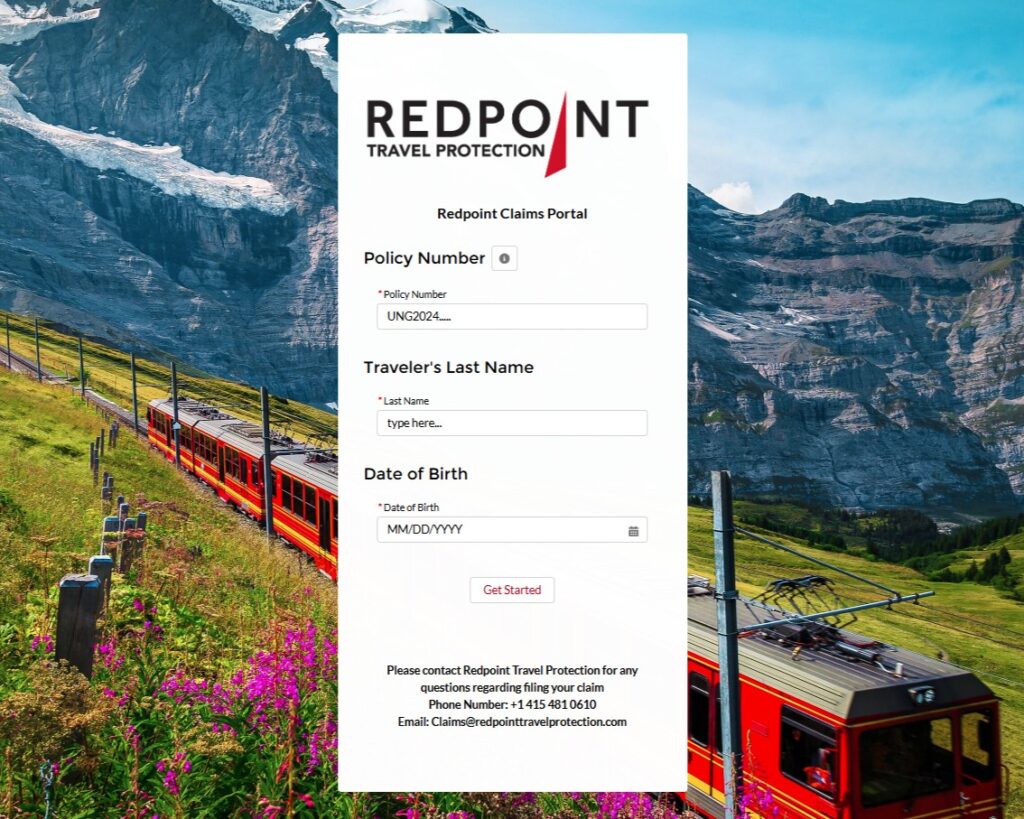

Now that you’ve gathered all the proof you may need, it’s time to make a claim. You can complete the claim form via Redpoint’s online portal. It will involve filling in a form with details of the incident and uploading any relevant proof. The process should take you about 20 minutes.

It’s important to meet any stated deadlines when making a claim. An otherwise successful claim can be denied if you don’t make it in a timely manner. In addition, if you want to speed up the process, include any and all proof that you have right from the start, even if you’re not sure it may be relevant. It’s better to provide all of the documentation up front, rather than be asked by your insurance provider to provide more further into the claims process.

Once you’ve done this, you can expect a response from Redpoint within 30 days. If you have questions about how to make your claim, or whether your documents are appropriate, you can contact Redpoint directly at +1 415-481-0610.

Step 4: Follow Up the Right Way

It’s important to have some patience when waiting for your claim to be resolved. Typically, your insurer will contact you if they need additional evidence to approve your claim. However, if you have not heard back from your insurer within the stated time frame (30 days), then you should follow up by contacting the claims line. You can call +1 415 481 0610 to check on the status of your claim at Redpoint.

Common Reasons Travel Insurance Claims Are Delayed (and How to Avoid Them)

Speeding up travel insurance claims is all about avoiding the common reasons that claims are delayed or denied. Here are some more travel insurance claims tips for what you want to avoid:

- Incomplete forms: Insurance forms can be detail-oriented and ask for a lot of specifics. If you’re not sure of the answers or need to get more information to provide them, it’s better to wait until you can fully complete the form before you submit it. Vague, incomplete forms are likely to lead to denials or delays.

- Late filing: Travel insurance companies will ask you to make your claim within a certain window (typically 30-60 days) after the incident occurred. It’s best not to procrastinate and file a claim as soon as possible after your trip. That way, your memory will be clearer, and it may be easier to track down any details you need to provide.

- Missing documentation: You can’t expect to have a successful travel insurance claim if you don’t have the right evidence to support it. Even if you’re telling the full truth about the incident or loss you experienced, you will need ample evidence to back it up. Don’t file your claim until you have gathered all the necessary documentation your insurer may need to validate what happened. Remember the insurer can’t take your word for it — they need documents that independently verify what happened, and how much it cost you.

Choosing the Right Plan Can Help Your Claim Process Later

Redpoint has a variety of travel insurance plans for different types of trips. Our Ripcord plan is for adventurous trips to remote or rural locations. Cavalry is for more standard trips to urban or luxury environments. And Harbor is for travelers who are traveling on a tight budget and need basic protection. Regardless of which plan you choose, we will do our best to provide a timely, fair response to your submitted travel insurance claim. You can explore all of Redpoint’s different insurance plans here.

FAQs About the Travel Insurance Claim Process

1. How long does a travel insurance claim take to process?

2. What documents are needed for a travel insurance claim?

3. Can I file a claim online with Redpoint Travel Protection?

4. What are common reasons claims are delayed or denied?

5. How can I avoid claim denial?

Need Help With a Claim? Contact Redpoint Today

Redpoint will work to resolve your claim in a timely and fair manner. If you need help or want to file a claim today, contact our customer support or visit our claims page.